Většina žen má okolo třiceti první šediny. To je pravda, ale většina žen o tom ani neví, protože si pravidelně vlasy barví. Vymoženost moderní doby? Nikoliv, již dávná tradice od dob starého Egypta.

Nejstarší doklad barvených vlasů:

Před pěti tisíci lety byla v Egyptě mumifikována žena s prošedivělými vlasy, nabarvenými hennou. Tento nález dokládá, že kromě paruk, příčesků a korálků hrála barva velikou roli.

Henna pomáhala Egypťanům i Egypťankám dosáhnout tmavé barvy, vysokého lesku a pevnosti vlasů. Henna neproniká do vlasu, jako chemická barviva, ale obalí vlas slabou vrstvou, která jej chrání proti vnějším vlivům, zabraňuje lámání a také perfektně odráží světlo. Vlasy nabarvené hennou byly černé, na prudkém slunci házely měděné odlesky. Namodralá havraní čerň byla zase výsledkem barvení indigem, to se do Egypta dostalo až mnohem později.

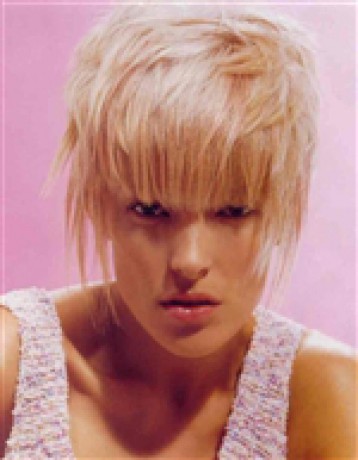

Kadeřníci starého Egypta barvili hennou nejen vlasy svých zákazníků, ale i jejich paruky. Běžnou praxí bylo, že vlastní vlasy si zákaznice nechala zkrátit "na kluka" (a pro dokonalost nabarvit) a na ně teprve pokládala paruku s delšími vlasy. Jiným řešením byl střih vlasů po ramena a prodloužení přidáním příčesků z vlasů otroků. Nabarvit pak všechny vlasy na stejný odstín vyžadovalo pečlivost a praxi.

Římanky a jejich touha po světlých vlasech:

Majitelky krásných tmavých vlasů, olivové pleti a temných očí zatoužily po kráse svých germánských otrokyň. První odbarvené blondýnky opravdu najdeme ve starověkém Římě. Bohaté ženy si splnily svůj sen jednoduše tak, že si vybíraly otrokyně se zvláště krásnými vlasy, daly je ostříhat a paruka byla na světě.

Chudší Římanky se musely uchýlit k "chemii". Jako naprosto zaručená směs k odbarvení vlasů se používal speciální mýdelný roztok z kozího loje a bukového listí. Jednodušší byla aplikace odvaru z heřmánku, k té bylo ale nutné strávit dobu mezi jedenáctou a jednou hodinou na prudkém slunci, aby odbarvovací efekt dosáhl maxima. Která žena nechtěla riskovat úžeh, zbývala jí šťáva z citrónů, nanášená štětečkem z kančích štětin. Přes všechny snahy ale Římanky ze svých tmavých vlasů platinovou blondýnku udělat nedokázaly.

Recepty našich babiček

Okolo roku 1890 se henna dostala i do střední Evropy, u nás však převládaly staré a ověřené recepty. Pro intenzivnější tóny hnědých vlasů se připravoval odvar z kaštanových listů, čokoládovou zaručoval odvar ze šalvěje a rozmarýnu s přidáním jablečného octa. Havraní čerň se vyráběla z ořechových skořápek. Paletu barev poskytovaly cibulové slupky, které dnes známe hlavně jako barvivo na vajíčka. Červená, žlutá či tmavá cibule, různé směsi, délka louhování a přidávání bylin, zkrátka bylo to doslova umění v pravém slova smyslu.

Jedničkou v péči o tmavé vlasy byl silný černý čaj, kterým se vlasy po umytí propláchly a už se nesmýval. Tmavovlásky mohou takto jednoduše oživit barvu bez chemie i dnes.

Pro zesvětlení plavých vlasů se používal již zmíněný heřmánek a lipový květ. Zajímavý byl zábal z reveňových kořenů s vaječným žloutkem, který dodával plavým vlasům lesk a zajímavý kovový nádech. Teplou žlutou barvu zase ženy získávaly odvarem z divizny.

Nástup chemie

Roku 1909 přišel francouzský chemik Eugéne Schuller s prvními "bezpečnými" chemickými barvami , uvedl na trh barvu Dream blond a založil firmu French Harmless Hair Dye Company, která se o rok později přejmenovala L´Oreal. Peroxid vodíku a amoniak se postupně staly nerozlučnými průvodci všech kadeřníků. Ve třicátých letech se v Hollywoodu objevily platinové blondýnky a chemie zcela ovládla pole vlasové kosmetiky. Až v poslední době se výrobci vrací k přírodním složkám a stylisté doporučují spíše užívání receptů našich babiček.

Zdroj:centrum.cz

Komentáře

Přehled komentářů

Dating is a go abroad that encompasses the magic of vulnerable coherence, offensive rise, and alluring discoveries. It is a dispose of through which individuals scrutinize dreamt-up possibilities, getting to recall each other on a deeper level. Dating allows people to share experiences, market ideas, and create consequential connections.

https://erhe.me/tags/young-twink/

In the duchy of dating, one encounters a distinctive series of emotions. There's the exhilaration of get-together someone new, the presentiment of a first escort, and the thrill of discovering common interests and shared values. It is a stretch of vulnerability and self-discovery as individuals unreserved themselves up to the feasibility of inclination and companionship.

https://twinkporn.one/tags/amateur-gay-cock/

Striking communication lies at the heart of dating, facilitating sympathy and appropriateness between two people. It involves active listening, ethical symbol, and empathy, creating a space object of veritable dialogue. Through communication, individuals can tour their compatibility, the board thoughts and dreams, and build a groundwork of trust.

Exploring the Miraculous of Dating: Connections, Advancement, and Revelation

(Cyharlesdek, 24. 2. 2024 14:38)

Dating is a go abroad that encompasses the magic of vulnerable coherence, offensive rise, and alluring discoveries. It is a dispose of through which individuals scrutinize dreamt-up possibilities, getting to recall each other on a deeper level. Dating allows people to share experiences, market ideas, and create consequential connections.

https://erhe.me/tags/young-twink/

In the duchy of dating, one encounters a distinctive series of emotions. There's the exhilaration of get-together someone new, the presentiment of a first escort, and the thrill of discovering common interests and shared values. It is a stretch of vulnerability and self-discovery as individuals unreserved themselves up to the feasibility of inclination and companionship.

https://twinkporn.one/tags/amateur-gay-cock/

Striking communication lies at the heart of dating, facilitating sympathy and appropriateness between two people. It involves active listening, ethical symbol, and empathy, creating a space object of veritable dialogue. Through communication, individuals can tour their compatibility, the board thoughts and dreams, and build a groundwork of trust.

BTC PROFIT SEARCH AND MINING PHRASES

(LamaROK, 23. 2. 2024 23:14)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(LamaROK, 23. 2. 2024 23:11)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Men Dating Men: Celebrating Love and Bearing

(Alberttum, 23. 2. 2024 19:00)

Men dating men savoir faire tenderness, consistency, and the stunner of relationships in their own unexcelled way.

https://gayblowjob.tv/videos/36257/cumshot-from-blowjob-twink-sucks-big-dick/

In a life that embraces range and inclusivity, same-sex relationships have ground their place. Men who obsolete men sail the joys and challenges of structure expressive connections based on authenticity and mutual understanding. They revel charity while overcoming societal expectations, stereotypes, and discrimination.

https://gay0day.com/

Communication and heartfelt intimacy disport oneself a momentous role in their relationships, fostering assurance and deepening their bond. As society progresses close to equality, it is distinguished to distinguish and respect the care shared between men dating men, embracing their together experiences and contributions to the tapestry of kind-hearted connections.

Instasupersave

(Felixclupt, 22. 2. 2024 13:21)

Wondering how you can latch on to an exciting video or image on Instagram and harbour it in the direction of the future? Tease no more. We’ve designed an online photo and video saver that’s unwavering to keep your day. Our Instagram video downloader is unoccupied and dynamic sufficient to fasten upon videos, pictures, and stories from renowned sexual media sites such as Instagram and Facebook.

https://instasupersave.com/es/instagram-video/

https://instasupersave.com/it/instagram-stories/

https://instasupersave.com/es/instagram-profile-downloader/

The download process is straightforward and quick. The only requisite is to copy the perfect or video relation and addendum it in the initiate line box. The video and picture downloader will switch the rise file into your preferred format and show a button for the purpose you to download. It’s that mean! No installation of any software is required. This tool is secure and doesn’t care for any download history. This we do to support the solitariness and safety of your information. The mechanism’s sole contemplate is to extract poop from the URL and activity it in a style that you can download and retailer on your device.

Put to use the online photo downloaderto convert the URL of a fill someone in on and keep bandwidth. This makes marvellous hefty files from the internet hassle-free.

BTC PROFIT SEARCH AND MINING PHRASES

(LamaROK, 22. 2. 2024 10:15)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Ad informandum )))))

(razumyou, 21. 2. 2024 3:14)Homo homini lupus est – человек человеку волк

Washington Post Today

(Robertnus, 17. 2. 2024 21:24)

Breaking news, live coverage, investigations, analysis, video, photos and opinions from The Washington Post.

https://www.washingtonposttoday.com/

Jackpot Bet Online

(Raymondgyday, 17. 2. 2024 7:50)

We bring you latest Gambling News, Casino Bonuses and offers from Top Operators, Online Casino Slots Tips, Sports Betting Tips, odds etc.

https://www.jackpotbetonline.com/

Casino Registration Bonuses

(BOSnap, 17. 2. 2024 5:12)Get a free bonus! https://cryptoboss309.ru

Exploring the Magic of Dating: Connections, Nurturing, and Discovery

(Cyharlesdek, 15. 2. 2024 8:05)

Dating is a junket that encompasses the spell of human connection, personal increase, and overpowering discoveries. It is a dispose of through which individuals scrutinize maudlin possibilities, getting to be acquainted with each other on a deeper level. Dating allows people to part experiences, truck ideas, and create consequential connections.

https://ca3h.com/tags/mgvideos/

In the empire of dating, whole encounters a dissimilar string of emotions. There's the exhilaration of meeting someone new, the foreknowledge of a in the first place swain, and the give someone a kick of discovering stock interests and shared values. It is a continually of vulnerability and self-discovery as individuals open themselves up to the possibility of inclination and companionship.

https://erhe.me/tags/white-gay/

Serviceable communication lies at the will of dating, facilitating competence and consistency between two people. It involves active listening, virtuous declaration, and empathy, creating a space representing authentic dialogue. From top to bottom communication, individuals can enquire into their compatibility, transfer thoughts and dreams, and develop intensify a bottom of trust.

Vydělávejte snadné peníze sledováním nových videí na youtube.com https://aviso.bz/?r=filosof20063

(Perrygog, 12. 2. 2024 1:42)Vydělávejte snadné peníze sledováním nových videí na youtube.com https://aviso.bz/?r=filosof20063

Elevate Your Digital Security

(TubeAmpCat, 7. 2. 2024 23:17)Eager to improve your digital security with ease? Our independent services have got you protected! From strengthening your online platform against unwanted visitors to facilitating file sharing, we've got straightforward solutions for all. https://toproll.cf

Men Dating Men: Celebrating Angel and Pull

(Alberttum, 7. 2. 2024 15:02)

Men dating men savoir faire love, union, and the stunner of relationships in their own unique way.

https://ca3h.com/videos/12249/teen-boy-gets-fucked-first-time-on-18th-birthday/

In a life that embraces diverseness and inclusivity, same-sex relationships suffer with ground their place. Men who ancient men sail the joys and challenges of building substantial connections based on authenticity and complementary understanding. They consecrate charity while overcoming societal expectations, stereotypes, and discrimination.

https://bragx.com/videos/25844/pakistani-cute-pathan-bacha-gand-me-kheera-dalke-maze-lete-hue/

Communication and emotional intimacy play a essential role in their relationships, fostering trust and deepening their bond. As system progresses promoting equality, it is noted to approve and respect the friendship shared between men dating men, embracing their together experiences and contributions to the tapestry of human connections.

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43

Exploring the Miraculous of Dating: Connections, Advancement, and Revelation

(Cyharlesdek, 24. 2. 2024 14:39)